The U.S. House of Representatives easily passed H.R. 3746, the Fiscal Responsibility Act, by a bipartisan majority of 314 to 117 on May 31, with 149 Republicans and 165 Democrats voting in favor, and 71 Republicans and 46 Democrats opposed.

The legislation, which now proceeds to the Senate, would suspend the $31.4 trillion national debt ceiling for two years until after the 2024 election and imposes discretionary spending caps totaling $1.5 trillion over ten years, expands work requirements for food stamps up to the age of 18-54 from the current 18-49 while exempting veterans, homeless and those leaving foster care from the work requirement resulting in a $2.1 billion increase in food stamps spending, a $900 million reduction in funding to the IRS and $11 billion of rescissions of unobligated balances, according to the Congressional Budget Office.

Included in the spending cuts — far less than the $4.8 trillion originally contemplated in the Limit, Save, Grow Act — U.S. taxpayers will only save about $188 billion in net interest owed on the spiraling national debt, compared with what would have been $547 billion under the House-passed Limit, Save Grow.

Other provisions that would have rolled back subsidies to green energy companies and prohibited President Joe Biden’s student loan forgiveness program were similarly removed from the final deal reached by House Speaker Kevin McCarthy (R-Calif.) and Senate Majority Leader Chuck Schumer (D-N.Y.) and Biden.

The legislation passed after some drama on passage of the rule on May 31 bringing the bill to the floor of the House, which saw 29 House Republicans vote no, thereby necessitating House Democrats to vote in favor of the rule. If all 71 House Republicans who opposed the bill had also opposed the rule, it might have failed, but on the other hand, if all 165 Democrats who supported the bill also supported the rule, obviously it would have easily passed as well.

For comparison, the 2011 Budget Control Act, which included similar budget sequestration in exchange for increasing the debt ceiling, passed 269 to 161, with 174 Republicans and 95 Democrats voting yes, and 66 Republicans and 95 Democrats voting no. And it passed the Senate 74 to 26, with 45 Democrats and 29 Republicans voting yes and 19 Republicans and 7 Democrats voting no.

Now, at the Senate level, it would take 41 Senators to block the legislation to force the bill back to the drawing board, which if they do not, promises to lock in the currently higher post-Covid budget levels for the next decade.

As a result of the deal, the national debt, which the White House Office of Management and Budget (OMB) projects will reach $50.7 trillion by 2033 under the current baseline, might come in at more like $49 trillion—assuming their original estimate was even accurate. Since 1980, the national debt has grown on average by more than 8 percent when recessions and wars are factored in. If it continues at that rate, the debt might come in at more like $69 trillion by 2033, and $100 trillion by about 2040.

To be fair, Limit, Save, Grow wouldn’t have done much better, with the debt at $46 trillion debt by 2033 instead of $50.7 trillion, again, assuming OMB is correct about the trajectory of the growth of debt, but again, the federal government has been grossly understating its projections for years, never accounting for potential wars and recessions.

True driver of debt might surprise you

Which is to say that obviously the so-called Fiscal Responsibility Act ignores the true drivers of the debt: declining fertility since the advent of birth control, which has declined to 1.66 babies per woman in 2021 compared to 3.65 babies per woman in 1960, resulting in fewer Americans working and the spiraling costs of Social Security and Medicare for the currently retiring group of seniors from the post-World War II baby boom.

In short, the programs pay out more benefits than they take in via revenue, and thus require an increasing population to sustain them. For now, the declining fertility is offset by some immigration, but declining fertility and the increasing average age of immigrants — median age of immigrants in 2021 was 47 compared to a median age of 37 for the U.S.-born population — tells us that is no long-term solution either.

As a result, mandatory spending, the bulk of which includes Social Security and Medicare, plus interest on the debt have risen from $2.38 trillion out of $3.77 trillion in 2011, or 63.1 percent of total spending, to $4.6 trillion out of $6.37 trillion in 2023, constitutes 72.7 percent of total spending.

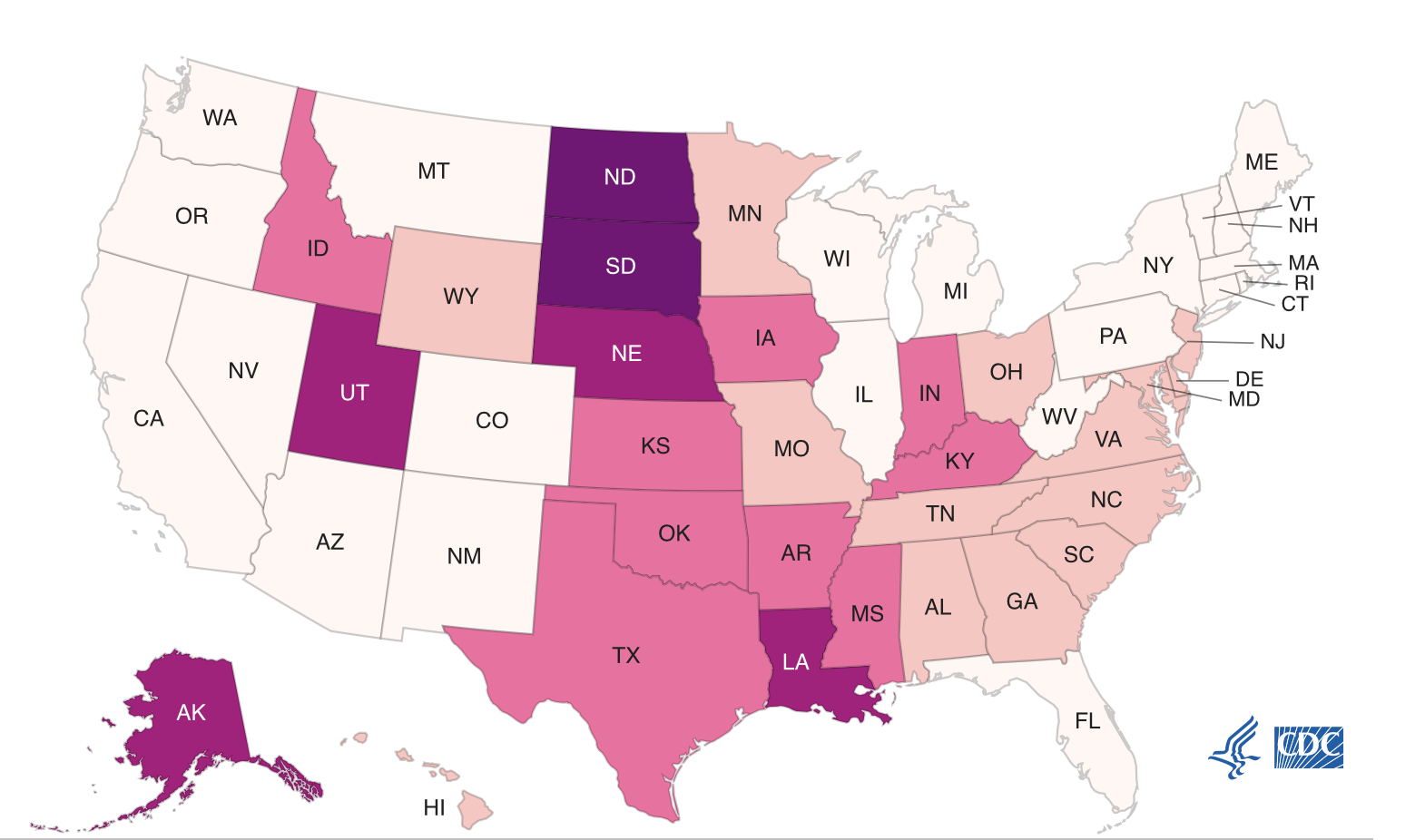

By 2033, mandatory spending plus interest, $7.75 trillion out of $9.95 trillion, will constitute a whopping 77.9 percent of total spending, thanks to the collective decision by Americans the past half century in red states and blue states alike not to have as many children. In fact, there isn’t a single state that has above population replacement levels, comparing 2008 to 2020, according to data compiled by the Centers for Disease Control and Prevention.

So, the problem isn’t that we don’t tax enough, it’s that we’re simply not adding enough new people to sustain this massive system of social insurance programs. We’re starving the system to death via complacency, an unwillingness to raise families and an overreliance on discretionary spending caps, which, again, account for a tinier and tinier piece of the budget.

And yet, the choices presented going forward, higher taxes and massive cuts to Social Security and Medicare once the trust funds run out, will be the solutions imposed on taxpayers and seniors under the guise of “reform”. Or you know, we could have more children, and yet in all the discussions around the conditions for increasing the $31.4 trillion national debt ceiling, it did not really come up.

Limit, Save, Grow, which would have been the biggest budget cuts in history, was better than the Fiscal Responsibility Act, which was better than doing nothing and just passing a so-called “clean” debt ceiling extension, but the truth is, none of the options that were presented with the American people truly addressed the demographic issues underlying our deep fiscal imbalance that depends on ever larger banks to buy trillions of dollars of treasuries, leading to hundreds of billions of unrealized losses when interest rates rise, as they must, to combat the inflation to do with printing money to pay cash out to Americans and to pay the debt. What we’re doing isn’t working.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government.